BDO Survey: Second-year ESG Reports Show Little Improvement in Level of Disclosure and Limited Gover

BDO Survey: Second-year ESG Reports Show Little Improvement in Level of Disclosure and Limited Gover

Published on 19 September 2018

Hong Kong listed companies should make a greater effort in ESG reporting to stay competitive in global markets

Hong Kong – While it is expected that listed companies should have a better understanding on the reporting requirements and capability to achieve better performances in the environmental, social and governance (“ESG”) reporting in the second year of its survey of ESG reporting in Hong Kong, the results of this year’s survey is still far from satisfactory with rooms for improvement. The newly-released study conducted by the BDO in Hong Kong, the world’s fifth largest accountancy network, reveals that performances in some areas have experienced no significant improvement and have even declined. In particular, the level of ESG disclosure and the top level commitment in ESG governance were disappointing.

BDO maintains its position at the forefront of the advocacy of excellence in ESG reporting. It was the first in the market to publish a survey report on ESG reporting standards of Hong Kong listed companies last year, and has continued its effort this year to mark improvements, reveal weaknesses and provide professional recommendations to market players. This year, the BDO Survey on “The Performance of ESG Reporting of Hong Kong Listed Companies” (“the Survey”) random sampled 400 of the most-recent ESG reports published by both Main Board and GEM-listed companies on or before 31 May 2018. The ESG reports were evaluated based on eight core subjects, namely, assurance, transparency, materiality, governance, energy / resource use management, supply chain management, customer support and anti-corruption.

Of the 400 companies surveyed:

- 8% were constituents of the Hang Seng Index, Hang Seng China Enterprises Index and/or the Hang Seng Corporate Sustainability Index, and 92% were non-index stocks.

- The Utilities sector led with the highest score (same as 2017), whereas the Materials and Information Technology sectors scored the lowest (same as 2017).

- In terms of data disclosure, the Energy, Industrial and Utilities sectors were leaders (Energy, Financial and Utilities in 2017) and the Conglomerates, Materials and Telecommunications sectors lagged (Consumer Goods and Information Technology in 2017).

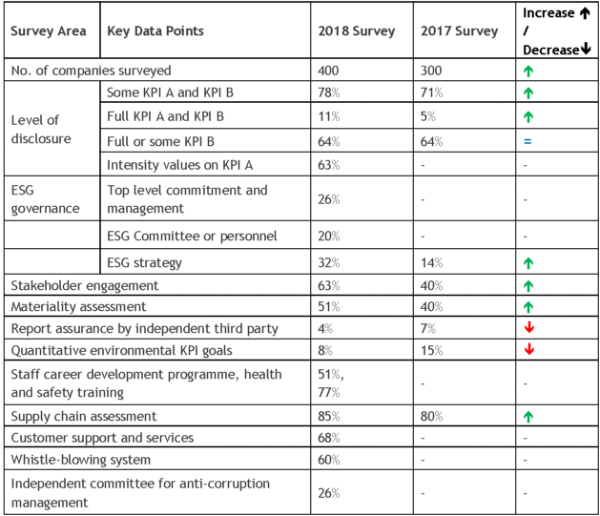

Below is a summary of the key findings of the 2018 Survey compared to the 2017 Survey:

Table 1: Summary of the Key Findings of the Survey on “The Performance of ESG Reporting of Hong Kong Listed Companies 2018”

Little improvement in ESG disclosure

According to the Survey, 78% of the sampled companies have disclosed KPI A and KPI B data. The difference is not significant when compared with the 71% in 2017. Although the percentage of full disclosure of KPI A and KPI B more than doubled, increasing from 5% to 11% in this year’s Survey, the figure remains low. The level of KPI B disclosure also remains unchanged at 64%.

Limited ESG governance effort

The Survey also reveals a low participation rate from the director level of 26% and only a relatively small portion of companies of 36% disclosed methodology and results on the identification of material issues, suggesting companies may be adopting a “tick-box” approach without proper identification and analysis of risks.

Low level of assurance and adoption of global standards

Little progress is shown in terms of raising credibility of ESG report by seeking third-party assurance, as only 4% of the ESG reports are verified and assured by third parties in 2018, representing a 3% decrease compared with the Survey in 2017. Companies referencing or adopting international standards in reporting also remains low at just 10%.

Lack of clarifications of ESG goals, challenges and setbacks

The Survey found that there is limited disclosure of ESG goals, challenges and setbacks, indicating a lack of long-term planning and strategy in ESG works. Just 17% of companies surveyed have reported ESG goals and among them only 8% have disclosed quantitative environmental targets, a 7% drop from 15% in 2017. Only 14% of the companies reviewed and reported last year’s performance targets and results, and discussed achievements against ESG goals. Only 1% of the companies discussed difficulties encountered in the implementing of ESG practices. Although some 32% of the companies mentioned their ESG strategy has shown improvement, up from last year’s 14%, the overall performance in this area is still far behind international standards.

BDO recommendations:

Although ESG reporting has cost implications, and small and medium enterprises (“SMEs”) understandably may not have resources comparable to established blue chips to invest in ESG reporting, the benefits of good ESG reporting, including better management of risks, improved reputation, better access to capital, cost savings, talent retention, etc, are applicable to all companies and should not be neglected regardless of the company size.

There are effective ways that even SMEs with fewer resources and less experience in ESG reporting can enhance their ESG report to their benefits:

- Set appropriate ESG goals and targets to drive performance towards an ultimate vision

- Review current ESG management policies and strategies to better position the business to realise the ESG goals and targets

- Increase director/senior level involvement, building a comprehensive and effective ESG governance framework

- Identify and engage key stakeholders, conduct proper identification and analysis of ESG risks and opportunities, and conduct a more thorough materiality assessment

On the other hand, with the growing appetite of investment funds in socially responsible investments, the companies which are better prepared to address ESG issues will be in a better position to be selected. Investors nowadays are not just looking for monetary returns but also on how well a firm is able to meet its ESG objectives and create corresponding, measurable values. Thus, a clearer and more interactive communication of ESG goals, initiatives and changes are more likely to inspire confidence in stakeholders and attract investors, paving way for more business and investment opportunities, particularly in green investment. BDO therefore recommends that companies with ample resources should strive to enhance their reports by embracing the international trend towards "impact reporting".

Blue chips to leap from 'ESG reporting' to 'Impact reporting'

“Impact reporting” is a way of reporting for companies or organisations to convey the positive impact and achievements and to describe details of the actions taken to initiate changes, and the measurement of changes and achievements so that stakeholders or the public can better understand the progress made. Impact reporting is a clear reflection on how the companies have managed their assets and funds presenting clear results and track records. When the impact is properly disclosed, investors would envisage the investment opportunities and advantages of those companies. Internationally, impact reporting has been increasingly important, and adopting this style of reporting in ESG reporting could more effectively inspire stakeholders to support a company's ESG initiatives and investments.

How to exercise impact reporting?

- Formulate the firm’s key vision: Through developing the vision for the firm which reinforces the core value of the business and is attractive to stakeholders, the company can differentiate itself from its peers by clearly articulating its long-term goal and direction towards contributing to the community and the business environment.

- Communicate ESG achievements in more interactive and informative ways: With an aim to inspire stakeholders to buy into the firm’s vision or even attract new investments, impact reporting is considered a more interactive type of reporting where more specific answers are provided to stakeholders compared to the typical ESG report format.

- Increase effectiveness and credibility of the ESG report by identifying compliance gaps, adopting international reporting standards and obtaining independent assessment: The benefits are obvious as it would enhance the quality, credibility and accountability of the reports when the above approaches can be realised.

- Develop suitable green finance strategies to capture the wave of climate-linked opportunities: It is necessary for companies to demonstrate the achievements and differences made in conservation and environmental protection, as well as how the company both controls risks and plans to focus efforts going forward to seize the expanding opportunities in green finance.

Ricky Cheng, Director and Head of Risk Advisory of BDO, said, “As investors increasingly examine a company based on a wider spectrum of performance details, ESG performance has become an essential concern in investment decisions. Companies with better ESG reporting would probably be seen as having better management and internal control in ESG issues and would definitely have an advantage over peers in the market. We are disappointed to see that the second-year of mandatory ESG reporting performance has shown only limited overall improvement, despite the rising popularity of responsible social investment attracting further attention to ESG reports. To capitalise on the wave of green investment/financing as well as to uphold Hong Kong’s reputation as an international financial hub, we believe that companies can pave the way for better business and investment opportunities by enhancing their ESG reports through following more global reporting practices. For companies with more established ESG reporting mechanism in place, they should take a step further to embrace the internationally trending concept of impact reporting with clearer and more interactive communication of ESG goals, initiatives and changes. We hope our suggestions can provide more specific guidelines and directions for companies to improve their ESG reporting, with the ultimate aim to boost their investment value and inspire investor confidence”.

-End-

Note to editors

About BDO

BDO's global organisation extends across 162 countries and territories, with close to 74,000 professionals working out of approximately 1,500 offices - and they're all working towards one goal: to provide our clients with exceptional service. BDO was established in Hong Kong in 1981 and is committed to facilitating the growth of businesses by advising the people behind them. BDO in Hong Kong provides an extensive range of professional services including assurance services, business services & outsourcing, risk advisory services, specialist advisory services and tax services. For more details, visit www.bdo.com.hk.

About the BDO ESG Awards

|

BDO held the inaugural BDO ESG Awards in Hong Kong in 2018.The BDO ESG Awards recognise outstanding listed companies in Hong Kong who have made a positive impact in the areas of Environment, Social and Governance (ESG) – particularly those who implement outstanding sustainability initiatives. The Awards aim to encourage companies to be more aware of their social responsibility to incorporate sustainability into their business model. The second BDO ESG Awards will be held in February 2019. For details, please visit: www.bdoesgawards.com |

Contacts

|

Sala Lo |

Tel +852 2218 3042 |

|

Heidi Lau |

Tel +852 2218 2325 |

Click here to download this press release (PDF format)