Published on 19 May 2020

.jpg.aspx?width=600&height=400)

The Government unveiled on 18 May, 2020 details concerning the application of the 1st tranche of subsidy under Employment Support Scheme (ESS), which employers and self-employed persons will be able to apply the subsidy under ESS online starting from 25 May, 2020 till 14 June, 2020. Please find the ESS website for your reference and online completion and submission of the application forms to the relevant authority for application of the subsidy. (The application forms for the 1st installment of the subsidy will be available from 7:00am, 25 May, 2020)

We would like to draw your attention to the details of application and obligations as follows:

1. Completion of the application form online

To facilitate completion of the application and subsequent vetting processes, applicant should fill in the application form with the relevant information as follows:

- Choose either December 2019, January, February, or March 2020 as the 'specified month' as the basis of calculation of the subsidy;

- Business Registration number, name of MPF trustee and name of MPF scheme and scheme registration/participation, bank account number of the employer);

- Upload a scanned copy of the bank statement; and

- Authorise their ESS processing agent to receive MPF records from their MPF trustee;

2. Undertaking to be provided by employers

For application of the 1st installment of subsidy under ESS, employers must give two undertakings to the government (the actual wording of the declaration of the undertakings is yet to be announced):

- Not to implement redundancy during the subsidy period from June to August 2020; and

- To spend all the government wage subsidies on paying wages to their employees.

The employers must keep the number of employees on payroll in June, July and August 2020 which cannot be less than the number of employees in March 2020.

3. Formula for calculation of claw-back of subsidy granted and penalty

a) Claw back

If employer fails to use all the wage subsidies received for a particular month during the subsidy period (June to August 2020) to pay the wages of employees in the same month, the Government will claw back the unspent balance of the subsidy as the formula below:

Subsidies received deduct total actual wages paid to employees.

b) Penalty

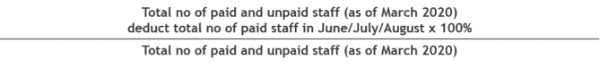

If the number of employees on the payroll in any one month of the subsidy period is less than the number of staff (whether paid or unpaid) in March 2020, the employer will have to pay a penalty to Government as the formula below:

Penalty of making redundancies in June/July/August 2020 = Subsidies received x Headcount reduction percentage x Penalty percentage

Headcount reduction percentage =

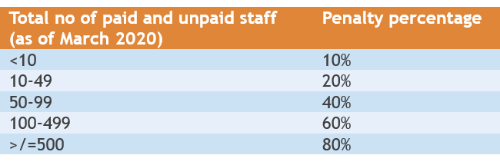

► Penalty percentage

c) Examples of calculation of claw back and penalty published by the Government

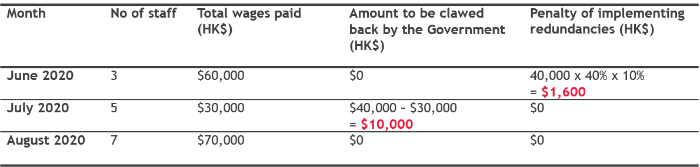

Example 1

- Number of employees in March 2020: 5

- Applicable penalty %: 10%

- Total wages subsidy (June to August 2020): HK$120,000 (ie monthly subsidy: HK$40,000)

Total penalty = HK$1,600 + HK$10,000 = HK$11,600

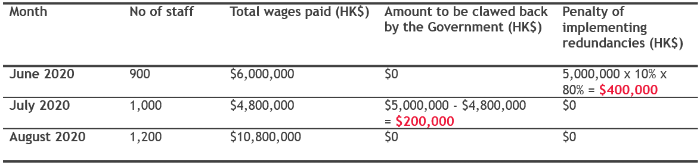

Example 2

- Number of employees in March 2020: 1,000

- Applicable penalty %: 80%

- Total wage subsidy received (June to August): HK$15,000,000 (ie monthly subsidy: HK$5,000,000)

Total penalty = HK$400,000 + HK$200,000 = HK$600,000

4. Auditing and monitoring mechanisms

During and after vetting of application, ESS Secretariat/processing agent will verify information submitted by employers and conduct on-site checking at selected employers’ organisations, if required, and will announce the list of employers who have received subsidies, the total number of employees benefited and the amount of subsidies received. This aims to allow the employees concerned or members of the public may report to the relevant authorities, should an employer be found to have abuse or violated the conditions of ESS.

If fraud is involved, the employer may consider committing a criminal offence and if convicted, may subject to prosecution.

In the meantime, please feel free to contact us to find out how we can assist you in respect of the application of the above subsidies.

Subscribe to receive the latest BDO News and Insights

Please fill out the following form to access the download.