Published on 5 May 2020

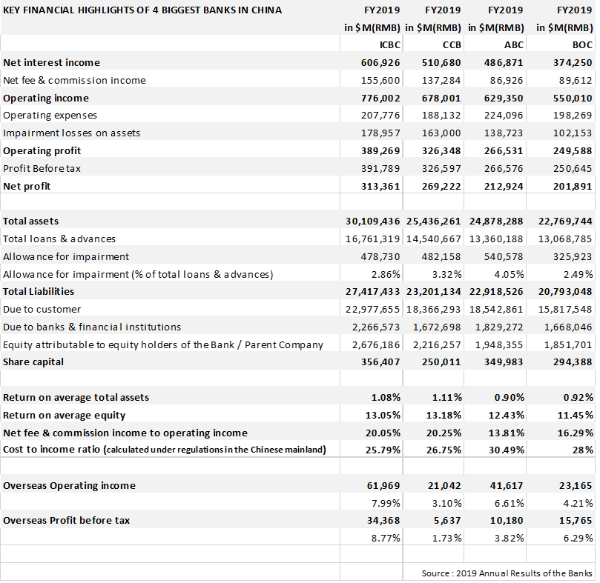

As you may correctly guess, the first thing we notice is the size of the Chinese banks. Based on the Global Finance Magazine, the top four biggest banks by assets in 2019 are all from China. The aggregation of these top four banks assets accounted for 48% of all top ten banks assets in the world.

Is bigger better?

The Chinese banks are highly profitable when comparing to their peers in the rest of the world. The profits before taxation of the big four Chinese banks were ranging from 42.36% to 50.49% of their operating incomes for the financial year end 2019, reflected extreme control over the operating expenses and staff cost. However, the impairment losses on assets were relatively high at around 19% to 24% of the operating income and had eroded the profit.

In term of the geographic segmentation of the business, most of the Chinese banks rely mainly on the domestic market for their revenue. For the big four Chinese banks, none of them derived more than 10% of the operating income from overseas.

The non-interest income to operating income ratio for the Chinese banks is generally lower than their western counterparts, as the Chinese government has been pushing the lending to the real economy activities. On the other hand, some US banks could get more than 40% of the operating income from non-interest income, mainly from the advisory, treasury, investment & asset management activities.

So, is this a fair comparison?

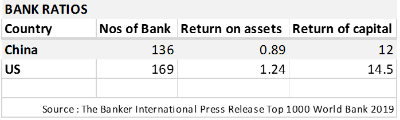

While the Chinese banks seen to be highly profitable, their returns on the asset and capital are relatively lower than the US counterparts based on The Banker press release on the Top 100 World Bank 2019. This is not difficult to understand as the objectives of western banks are generally to maximise the profit and returns to the shareholders while the Chinese banks are to support the direction and industries based on the long-term plans of the Chinese economy.

As most of the Chinese banks are either directly or indirectly owned by the state, the Chinese banks especially for the mega one will likely be supported by the government when there is a financial crisis. While said, Chinese banks are still expected to make a decent profit and keep the balance sheet intact. As we do see the government letting few smaller financial institutions to fail in the recent years.

On the other hand, most regulators in the West will intervene and provide lifeline to the banks only when there is a major financial crisis, as we saw in 2008. The government, however, will normally charge the banks and sell their holding of the banks once the situation is stabilised. Nevertheless, all governments have the obligation to protect the public deposits and to ensure stability of the economy as the whole.

With the wider spread of coronavirus and its impact to the world, many credit agencies have revised the credit rating of the banking sector which is typically the yardstick for the health of the economy. In earlier April, Moody has downgraded the outlook on 12 Asia Pacific banking system to negative in view of the coronavirus outbreak and the broad deterioration in the economy in these countries.

S&P has also estimated that a prolonged coronavirus could cause China’s non-performing loan ratio to be more than triple and will peak at 11.5% of gross loan in the aftermath of the pandemic.

Looking around at the other two big global economies, US & Eurozone have not done a better job in keeping the virus in control. With the worsen pandemic situation in these economies, the non-performing loans are expected to rise.

As a result, we may see a wider change in the banks’ ranking next year, which could be very much depending on how well the countries and banks deal with the pandemic today.

Subscribe to receive the latest BDO News and Insights

Please fill out the following form to access the download.