Published on 5 May 2020

Agnes Cheung, Director and Head of Tax

Abigail Li, Principal of Tax

In the 2020/21 budget speech delivered on 26 February 2020, Financial Secretary Paul CHAN Mo-po proposed additional funding and incentives to support Hong Kong’s pillar industries and other sectors. Financial services was identified as the focus to drive the growth of Hong Kong’s economy.

Under the shadows of public concerns over the novel coronavirus and economic slowdown, the Financial Secretary (FS), Mr Paul Chan Mo-po, delivered his fourth Budget Speech on 26 February 2020. As widely expected, Mr Chan revised his budget for 2019/20 from surplus to a deficit of HK$37.8 billion. Estimated government revenues are HK$58.8 billion lower than the original estimate primarily due to drop in revenue from profits tax and salaries tax caused by unfavourable social and economic conditions, enhanced tax concessions as well as delay in issuing tax assessments. Estimated government expenditure, on the other hand, is HK$3.6 billion higher than the original estimate. The year ahead would continue to be challenging and difficult, and a record high deficit of HK$139.1 billion was envisaged for 2020/21.

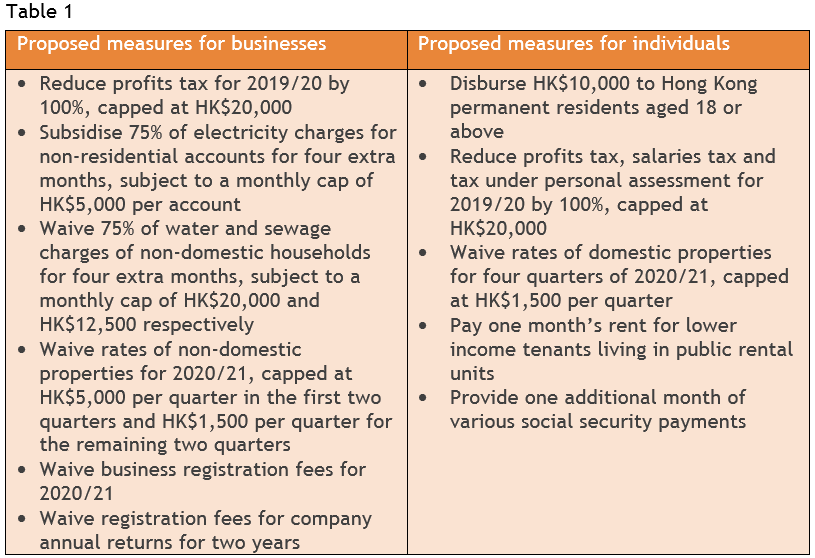

Short-term reliefs

Short-term relief measures including tax reduction, property rates and business registration fee waivers were proposed, as in previous bad years, to support enterprises, safeguard jobs, stimulate the economy and smoothen livelihoods. Key immediate reliefs are highlighted in Table 1.

Medium-term strategies

The FS forecasted for 2020/21 a record high deficit of HK$139.1 billion or -4.8% in terms of percentage of GDP. The fiscal reserves at the end of 2020/21 was forecasted to be 16 months in terms of number of monthly government expenditure. The FS estimated the Government would continue to operate on lesser deficit budget of HK$15 billion on average for 2021/22 to 2024/25 with fiscal reserves to cover an average of 15 months of government expenditure upon the projection or assumption that Hong Kong’s GDP growth trend rate for 2021 to 2024 is kept at 2.8%.

Tax incentives for the financial services sector

The FS proposed additional funding and incentives to support Hong Kong's pillar industries and other sectors. Financial services was identified as the focus to drive the growth of Hong Kong's economy.

In order to further promote Hong Kong as an international asset and wealth management centre and to redefine Hong Kong's regional role with development of the Greater Bay Area, the FS announced the Government's plan to provide tax concession for carried interest issued by private equity funds, alongside with the establishment a limited partnership regime, to attract more private equity funds to domicile and operate in Hong Kong.

He also proposed to waive stamp duty on stock transfers paid by the Exchange Traded Fund (ETF) market markers when creating and redeeming ETF units in Hong Kong to save transaction costs for ETFs. The estimated loss of stamp revenue was HK$400 million per year.

Tax concessions for the ship leasing business, including profits tax exemption to qualifying ship lessors and a half-rate profits tax concession to qualifying ship leasing manager, were designed to boost ship-leasing activities in Hong Kong. The draft bill was gazetted on 17 January 2020.

The offering of a half-rate profits tax concession for eligible insurance businesses including marine insurance was aimed at reinforcing Hong Kong's position as a major insurance hub. The draft bill was gazetted on 6 December 2019 and first-read in the Legislative Council on 18 December 2019.

The Government planned to issue green bonds totalling HK$66 billion within the next five years further to its inaugural green bond issue last year under the Government Green Bond Programme. It also planned to launch, at least HK$13 billion in size, further issuance of iBond to promote further development of the retail bond market and silver bonds to encourage development in the financial market for more senior members of the public.

Hong Kong tax system

The FS acknowledged the main reason for the anticipated deficits for the 2021/22 to 2024/25 financial years is that government revenue cannot keep up with the drastic increases in expenditure (especially recurrent expenditure) and there may be a need to consider new revenue sources or tax rate revision.

The FS announced at the end of the Budget Speech that the Government would seek advice from scholars, experts and members of the business community on the impact on Hong Kong tax regime in light of the OECD's proposal of setting rules for imposing a global minimum tax rate1.

Observations and suggestions

This fiscal landscape now is not unlike what Hong Kong saw about 20 years ago when it was trying to come out of the Asian financial crisis but found itself in midst of global slowdowns in major economies such as the US and Japan. Global economic dynamics have changed over the past 20 years though. China's economy has become the second largest in the world by GDP next to the US and closely intertwines with Hong Kong’s economy. Now with potential economic slowdowns also in China, Hong Kong may not be able hitch a ride alongside China to re-bounce quickly as it did 20 years ago with China’s entry to the World Trade Organisation.

Hong Kong has to implement effective measures to at least maintain its existing average GDP growth rate in the next few years if the FS'forecast is to hold as this is a material assumption. Government revenue has to increase to restore fiscal balance for long-term planning. One would have expected ideas from the Government on how it plans to achieve this goal.

From a tax perspective, except for an indication of the intention to offer tax concession for carried interest issued by private equity funds operating in Hong Kong, the measures discussed in the Budget Speech are brought forward initiatives such as tax incentives for ship leasing activities and eligible insurance business, and a limited partnership regime for private equity funds.

Tax concession for carried interest would definitely increase asset and wealth management activities and promote Hong Kong as the preferred asset and wealth management centre provided the qualifying conditions are attractive. Clear rules with bright-line tests would also provide tax certainty for asset and wealth management industry.

A focus on government bond issuance reflects the Government's awareness of the popularity of fixed income securities particularly at times of financial instability like the present. The Government offers a half-rate profits tax concession by including the green bonds issued last year under the Qualifying Debt Instrument Scheme. Bolder tax measures such as full tax exemption for investors and super deduction on issuance costs for issuers may be considered to incentivise both issuance and subscription of other green bonds to promote a long-term sustainable economy.

In respect of the bond market in general, one may recall the Inland Revenue Department's stated position of treating interest income on fixed income securities as "incidental transactions" to be subject to general tax principal outside the scope for tax exemption under the fund exemption regimes in Hong Kong. That means a Hong Kong managed bond fund is technically subject to Hong Kong profits tax in respect of its interest income of a Hong Kong source. The issue of source of interest income is complex. Bond funds currently have to live with a degree of tax uncertainty. This may be the perfect timing for the Government to expand the scope of fund exemptions to cover interest income and provide tax certainty to make Hong Kong an even better asset and wealth management centre and bond market in the region.

The FS indicated the possibility of new taxes or increased tax rates in his Budget Speech. In the weeks after the Budget Speech, goods and services tax (GST) returned as a discussion topic after the Government's attempts to propose it in 2000 and 2006. Will the third time be a charm?

Introduction of a GST is bound to be controversial. It may be easier to start with digital tax and luxury goods tax as BDO Limited has proposed to the FS2. Quite a large number of jurisdictions have introduced digital tax, including Hong Kong's major competitor Singapore, as their response to taxation of digital economy.

Indeed, tax has finally moved up the global socio-economic agenda as it ought to. The Organisation for Economic Cooperation and Development (OECD), which has been driving international actions against base erosion and profit shifting (BEPS) since 2015, is currently pushing forward BEPS 2.0 which includes a proposal for a global minimum tax to further counter global base erosion (GloBE).

The implementation of the GloBE rules can significantly undermine the existing advantages in Hong Kong’s tax system where, with capital gain exemptions, offshore claims and half-rate tax concessions, effective tax rate is often quite low. GloBE is going to create a new balance of international taxing rights. The FS prepared the audience in his Budget Speech that Hong Kong's simple and low tax regime may have to change. Despite roars for change, concrete action plans on a holistic review of the Hong Kong tax system with a view to achieving the objectives of increasing tax revenue for Hong Kong, protecting Hong Kong's taxing right amongst other jurisdictions as well as being compliant with global tax agenda are much expected.

The OECD is very actively driving the implementation of GloBE within 2020. Hong Kong has to react fast.

Notes:

2. For more details, please refer to BDO's Budget Proposals

© Copyright Hong Kong Institute of Bankers and Wolters Kluwer. Published in the March/April 2020 issue of Banking Today journal.

Subscribe to receive the latest BDO News and Insights

Please fill out the following form to access the download.